It was great to see the Zoological Society of London’s Rhino Impact Bonds work featured in the Financial Times last month. I first came across this initiative in my past role at Fauna & Flora International, who act as an adviser to the work alongside United for Wildlife, a project from the Royal Foundation of The Duke & Duchess of Cambridge and the Duke & Duchess of Sussex. The initiative is managed by our friends at Conservation Capital.

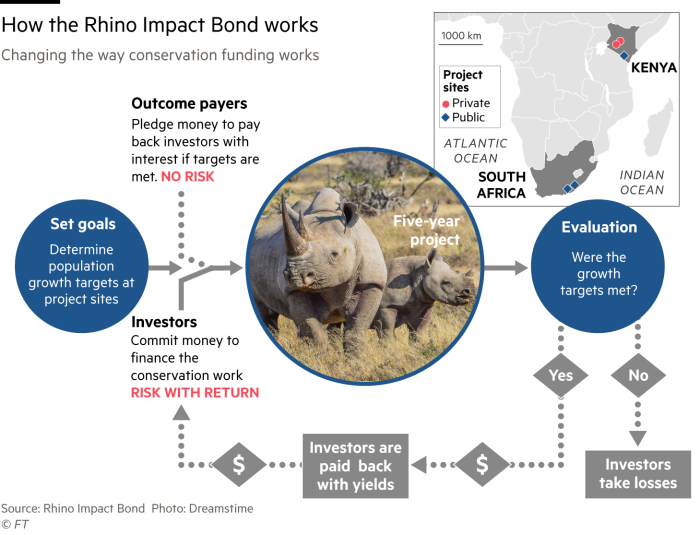

The project is complex, but at its heart is a desire to demonstrate innovative ways to finance conservation work that bring in the significant financial and technical capability of the private sector and financial markets. In doing so, it leverages capital markets to raise the upfront finance needed to halt the decline of rhinos, offering investors a financial return on their money. It also puts the risk of success or failure with those investors, rather than the public bodies or charities and foundations that usually fund this type of work.

For the cash-strapped public bodies that do normally finance these projects, its an extremely attractive model: they commit to covering the cost of repaying the investors on delivery of the agreed results: that is, no loss of rhinos at the sites where the work is taking place. If rhino number increase, then investors get their money back with a modest return; if rhino numbers drop, investors lose their money. Attracted by the guarantee of only paying out on positive outcomes, public bodies are happy to pay out more for successful projects. As such, the risk of the project is shouldered by the private sector.

This doesn’t sound like a great deal for the investors, but only if you factor out the relative sea change in the way the market views long-term returns on social and environmental investments. Many of the big financial institutions are looking for innovative models that deliver positive social and environmental impact. Taking the long view, the finance sector is starting to realise the material risk that climate change and biodiversity loss pose to global financial markets, which fundamentally depend on natural capital. Those interested in this initiative include the likes of Credit Suisse.

All of which sits well with Wild Philanthropy’s own investment model, which is built on demonstrating how the tourism sector can operate in different ways to achieve much greater local impact, one that empowers local communities whilst protecting at risk ecosystems. The ongoing development of a species-specific initiative such as the Rhino Impact Bond is a fantastic thing – I can easily envisage how this could be rolled out to other species in the future, and look forward to seeing the project (and others like it) play an increasingly important role in addressing the $1 billion / day funding gap that Conservation Capital’s Giles Davies talks of in the article. Watch this space – its growing.

If you this has article piqued your interest, and you would like to find out more about how to impact invest in at-risk ecosystems, please do get in touch. We’d love to help.